While the Portfolio Intelligence Platform gives an aggregate view, the Risk Intelligence Platform looks at the individual assets. With it, you can assess the risks of your loans and restructure the terms when needed, you can discriminate between riskier vs safer deals, meet regulatory compliance such as capital allocation under Basel III or Solvency II, and facilitate central reporting.

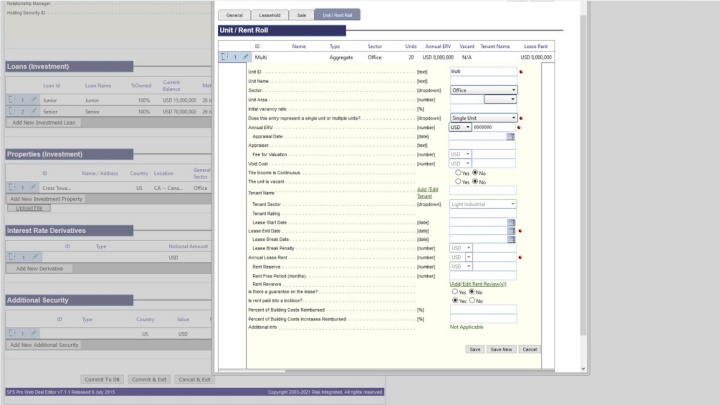

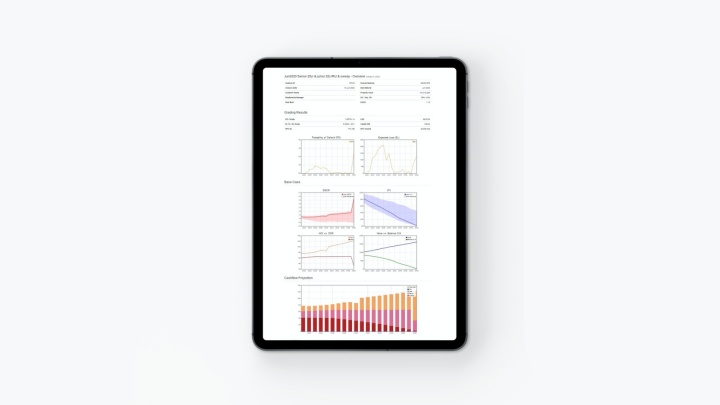

When time is of the essence, it’s important to have the fastest, most accurate tools. The Risk Intelligence Platform gathers anywhere from 20 to 2000 points of data on each deal and runs a sophisticated Monte Carlo analysis over data from the last 20 years. In that process, it tests the strength of cashflows against market changes in rents, capital values and vacancies, and against economic changes in inflation, interest rates and FX, as well as against tenant changes of lease reviews, expirations and defaults. Meanwhile, for construction projects, it also tests cost-overruns, delays and the possibility of shortfalls in future sales and leases. And it all comes in an easy-to-read format, within minutes, onto your screen.

With the Risk Intelligence Platform, you can centrally monitor your portfolio and comply with regulations using structured transactions and regulatory reports. Specifically, you will be able to

- See the probability of default, loss given default and required spread per year

- Reduce spikes in risk by restructuring amortization, changing interest terms, adding covenants, adding interest derivatives or changing seniorities.

- After closing a deal, generate portfolio reports for management, investors, rating agencies, Basel III, Solvency II, stress testing and IFRS-9 CECL.

- Multiple users

- Stress testing and scenario analysis to measure the impact on portfolio

- Instantly visualize the impact of restructuring portfolio or asset level debt

- Analyse risk on a lease-by-lease basis using regulatory-grade risk analysis framework – as used by leading global banks and insurers

- Software as a Service

- Price on request